Milan, 20 April 2017 – The Shareholders’ Meeting of 2i Rete Gas S.p.A., chaired by Ms Paola Muratorio, approved today the separate and consolidated financial statements at 31 December 2016, showing a Net profit of 129 million euro, as well as the payment of 85 million euro in dividends, confirming the proposal the Board of Directors made on 17 March 2017.

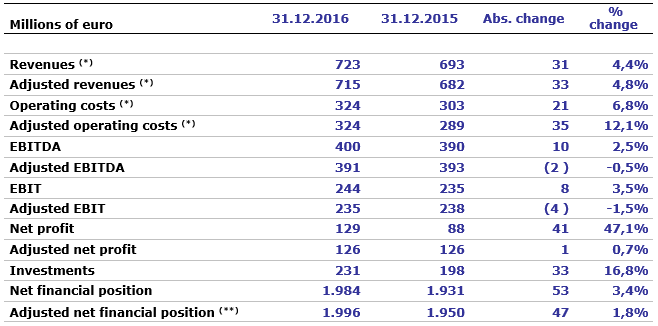

Financial highlights

- Revenues 723 million euro (+4.4%)

- Adjusted EBITDA: 391 million euro (-0.5 %)

- Adjusted EBIT: 235 million euro (-1.5%)

- Net profit: 129 million euro (+47.1%)

- Adjusted net profit: 126 million euro (+0.7%)

- Investments 231 million euro (+16.8%)

- Adjusted net financial position: 1,996 million euro

Operational highlights

- Active concessions: 1,943

- Active redelivery points: 3,900,186 (+2.1%)

- Distributed (Natural and LPG) gas in millions of m3: 5,455 (+0.8%)

- Km of pipelines operated: 58,244 (+1.0%)

The comment of Michele De Censi, Chief Executive Officer and General Manager of 2i Rete Gas:

“Despite the lower regulatory WACC, 2i Rete Gas achieved outstanding results thanks to growth strategies oriented to constantly drive greater operational and financial efficiency.

In addition, during the year the company renegotiated the revolving line of credit, and in December 2016 it finalised a 225 million euro loan with the European Investment Bank at particularly favourable rates, further curbing its funding cost structure.

In 2016, design work focused mainly on area tenders, which represent for the company the prospect of growing in the gas distribution market.

Finally, the results achieved allowed 2i Rete Gas to distribute 85 million euro in dividends in 2016 as well, with a 67% payout as a proportion of adjusted net profit.”

In 2016, 2i Rete Gas S.p.A. generated 723 million euro in Revenues, excluding the items offset in costs. The amount included 9 million euro in non-recurring income: therefore, in 2016 adjusted Revenues totalled 715 million euro (682 million euro in 2015). The increase was essentially attributable to the higher revenues from energy efficiency certificates (as a result of the higher number of certificates purchased during the year compared to 2015), even though transport revenues declined by nearly 18 million euro due to the lower regulatory WACC.

In 2016, Adjusted operating costs amounted to 324 million euro (289 million euro) and did not include non-recurring expenses. Excluding the 9 million euro rise in the costs for energy efficiency certificates, operating costs fell by 8.3%.

The Adjusted EBITDA totalled 391 million euro, down 2 million euro (-0.5%) from 2015. The Adjusted EBIT totalled 235 million euro, down 4 million euro (-1.5%) from 2015.

The Net profit for 2016, amounting to 129 million euro and up 41 million euro from 2015 (+47.1%), reflected the contribution from EBIT as well as the reduction in income tax expense. The Adjusted net profit totalled 126 million euro, essentially in line with the previous year (+0,7%), thanks to the decline in financial charges compared to 2015 (-5 million euro).

During 2016, 2i Rete Gas S.p.A. made gross investments totalling 231 million euro, up from the previous year (198 million euro), mainly as a result of the increased investments in the networks and electronic meters.

The Adjusted net financial position was up from 1,950 million euro in 2015 to 1,996 million euro at 31 December 2016 (+47 million euro), mainly due to the increase in working capital associated with energy efficiency certificates as well as to the rise in investments.

The Adjusted net financial position/adjusted EBITDA ratio for 2016 was up to 5.1x from 5.0x at the end of 2015.

The Consolidated Annual Financial Report at 31 December 2016 will be published on the company’s website www.2iretegas.it.

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from the construction of distribution infrastructure recognised in accordance with IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (207 and 170 million euro in 2016 and 2015, respectively), are accounted for as a deduction of the relevant costs.

(**) Excluding the adjustment to the payables for transaction costs associated with loans (12 and 19 million euro in 2016 and 2015, respectively) pursuant to IAS 39.