THE BOARD OF DIRECTORS OF 2i RETE GAS APPROVES THE RESULTS AT JUNE 30th 2021

Today, the Board of Directors of 2i Rete Gas S.p.A. (“2iRG”) approved the Consolidated Interim Financial Report at June 30th 2021.

Financial highlights

- Revenues: 365 million euro (+4.9%)

- Adjusted EBITDA: 246 million euro (+2.8%)

- Adjusted EBIT: 144 million euro (+3.6%)

- Net profit: 96 million euro (+21.4)

- Adjusted net profit: 83 million euro (4.8%)

- Investments: 178 million euro (+37.9%)

- Adjusted net financial position: 2,821 million euro (+7.3% compared to June 30th 2020)

Operational highlights

- Active concessions: 2,210

- Active redelivery points: 4,511,133 (+3.9% compared to June 30th 2020)

- Distributed (Natural and LPG) gas in millions of m3: 3,778 (+15.3% vs. June 30th 2020)

- Km of pipelines operated: 69,596 (+5.0% compared to June 30th 2020)

In the first half of the current year, 2iRG reported 365 million euro of Revenues net of line items offset with costs and includes non-recurring items (equal to zero during the analyzed period). Adjusted revenues item is therefore 365 million euro vs. 348 million euro of June 2020. The increase is largely attributable to higher distribution revenues, due to the change in the scope of consolidation of the Group after the contribution of Infrastrutture Distribuzione Gas S.p.A. (“IDG”) from 30th April 2021.

Adjusted operating costs in the first half of 2021 totaled 119 million euro, with an increase of about 10 million euro compared to the previous period (+9.1%). The figure does not take into account non- recurring items – equal to 0.2 million euro during the period. There was a growth in operating costs mainly due to the change in the scope of consolidation, positively counterbalanced by lower raw material costs and efficiency of personnel costs for investment activities.

Adjusted EBITDA amounted to 246 million euro, 7 million euro higher than in June 2020.

Adjusted EBIT amounted to 144 million euro, 5 million euro higher than in June 2020.

The Adjusted net profit for the period is equal to 83 million euro, 4 million euro higher than in June 2020. The 2021 non-recurring items concerned the overall positive fiscal impact (14 million euro) strictly related to the first part of realignment of fiscal and statutory values of goodwill following mergers in the parent company.

In the first half of 2021, 2iRG’s gross investments amounted to 178 million euro (vs. 129 million euro, as of June 2020). The increase was largely attributable to the higher investments for technical improvement activities and renewal of the distribution network.

Net fixed assets in June 2021, mainly represented by intangible assets related to gas distribution concessions, are equal to 3,862 million euro, 297 million euro higher compared to June 2020 (+8.3%). The increase is driven by the normal trend of investments and the change in the scope of consolidation of the Group.

The adjusted net financial position rose from 2,628 million euro in the first half of 2020 to 2,821 million euro as of 30 June 2021 (+193 million euro). The growth is mainly due to the amount paid to Edison for the acquisition of IDG and to higher technical investments.

The Consolidated Annual Financial Report at June 30th 2021 will be published on the company’s website www.2iretegas.it.

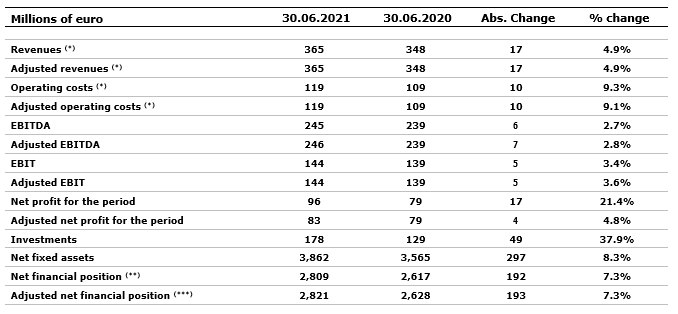

The following table illustrates the main financial figures of the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (164 and 121 million euro in the first half of 2021 and 2020, respectively), are accounted for as a deduction of the relevant costs.

(**) Including the debt registered following the application of the IFRS16 principles (equal to 21 and 27 million euro in the first half of 2021 and 2020, respectively).

(***) Excluding the non-current financial assets for the costs on loan and the adjustment to the payables for transaction costs associated with loans pursuant to IAS 39 (11 and 11 million euro in the first half of 2021 and 2020, respectively).