Adjusted EBITDA up to 462 million euro (+12.7%), Adjusted NET PROFIT up to 156 million euro (+7.9%) and INVESTMENTS up to 288 million euro (+11.6%)

The Shareholders’ Meeting of 2i Rete Gas S.p.A. approved today the separate and consolidated financial statements at 31 December 2018, showing a Net profit of 155 million euro, as well as the payment of 93 million euro in dividends, confirming the proposal the Board of Directors made on 25 March 2019.

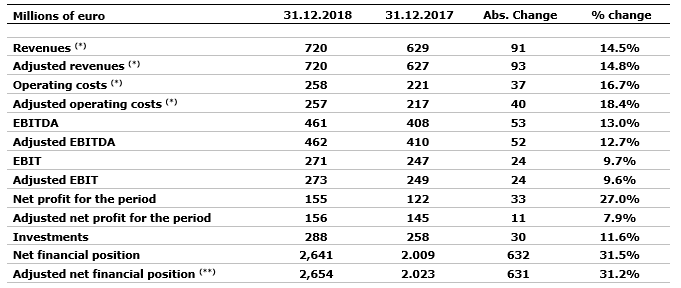

Financial highlights

- Revenues: 720 million euro (+14.5%)

- Adjusted EBITDA: 462 million euro (+12.7%)

- Adjusted EBIT: 273 million euro (+9.6%)

- Net profit: 155 million euro (+27.0%)

- Adjusted net profit: 156 million euro (+7.9%)

- Investments: 288 million euro (+11.6%)

- Adjusted net financial position: 2,654 million euro

Operational highlights

- Active concessions: 2,150

- Active redelivery points: 4,395,955 (+12.2%)

- Distributed (Natural and LPG) gas in millions of m3: 6,040 (+5.2%)

- Km of pipelines operated: 66,263 (+0.6%)

Michele De Censi, 2i Rete Gas Chief Executive Officer and General Manager, has commented as follows:

“2018 was a very important year for the Group and it ended with excellent results. Thanks to the the acquisition of Nedgia S.p.A from Naturgy (formerly Gas Natural Fenosa) we finalised the most relevant M&A deal of the gas distribution sector of the last years (223 concessions and ca. 7,300 km of network) and we completed the integration in our organization and in our business model briefly.

The outcomes immediately benefited from it and they allowed a dividend distribution of 93 million euro with a 60% payout on the adjusted net profit.

During 2019, the Company will continue to put in place actions aimed at promoting innovation and transformation in the gas distribution segment, through the implementation of the relevant investment plan in the distribution and metering infrastructures and in the linked systems.”

In 2018, 2i Rete Gas S.p.A. generated 720 million euro in Revenues, net of items which are offset in the costs, without non-recurring incomes in the period. The adjusted Revenues, equal to 720 million euro, were about 93 million higher in comparison with 2017 (+14.8%). The increase was mainly due to the change in the scope of consolidation of the Group after the contribution of 2i Rete Gas Impianti S.p.A (formerly Nedgia S.p.A).

In 2018, Adjusted operating costs amounted to 257 million euro (217 million euro in 2017) and did not include non-recurring expenses of 1 million euro concerning the acquisition transactions charges registered in the period. The raise was due to the change in the scope of consolidation and to the negative margin of the energy efficiency certificates, notwithstanding the operating costs’ efficiency.

The Adjusted EBITDA amounted to 462 million euro, up 52 million euro (+12.7%) in comparison with 2017. Net of the effect of change of the scope of consolidation and the impact of the energy efficiency certificates, the Adjusted EBITDA has grown by 14 million euro.

The Adjusted EBIT totalled 273 million euro, 24 million euro higher than 2017 (+9.6%).

The Adjusted net profit was equal to 156 million euro, up 11 million euro from 2017 (+7.9%), due to the higher Adjusted EBITDA, counterbalanced by higher adjusted financial charges and tax expenses.

During 2018, 2i Rete Gas S.p.A. put in place gross investments of 288 million euro (258 million euro in 2017), increase mainly given by greater investments for technical improvement activities and renewal of the distribution network.

Net fixed assets in 2018, mainly represented by intangible assets related to gas distribution concessions, were equal to 3,474 million euro, 735 million euro higher compared to 31 December 2017 (+26.8%). The increase was driven by the change in the scope of consolidation of the Group from February 2018.

The Adjusted net financial position was up from 2,023 million euro in 2017 to 2,654 in 2018 (+631 million euro), due to the amount paid to Naturgy for the acquisition of 2i Rete Gas Impianti S.p.A (formerly Nedgia S.p.A).

The Adjusted net financial position/adjusted EBITDA ratio at the end of 2018 increased from 4.9x (as of December 2017) to 5.7x.

The Consolidated Annual Financial Report at 31 December 2018 will be published on the company’s website www.2iretegas.it.

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (266 and 238 million euro in 2018 and 2017, respectively), are accounted for as a deduction of the relevant costs. From 2018 revenues and costs for TEE items will be registered aggregately and will be accounted as margin (positive/negative). For the sake of clarity 2017 items have been reinstated, in order to be comparable with 2018 data.

(**) Excluding the adjustment to the payables for transaction costs associated with loans (13 and 13 million euro in 2018 and 2017, respectively) pursuant to IAS 39.