THE BOARD OF DIRECTORS OF 2i RETE GAS APPROVES THE RESULTS AT JUNE 30th 2020

Today, the Board of Directors of 2i Rete Gas S.p.A. (“2iRG”), during the meeting chaired by Ms Paola Muratorio, approved the Consolidated Interim Financial Report at June 30th 2020.

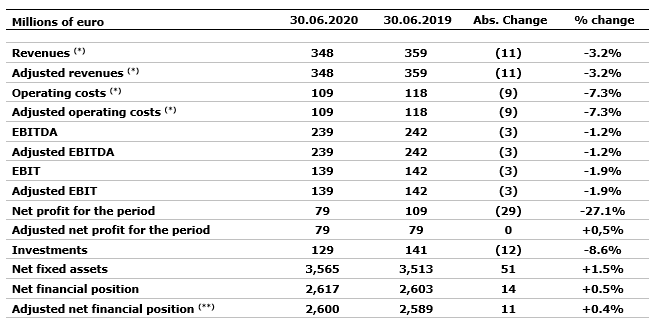

Financial highlights

- Revenues: 348 million euro (-3.2%)

- Adjusted EBITDA: 239 million euro (-1.2%)

- Adjusted EBIT: 139 million euro (-1.9%)

- Net profit for the period: 79 million euro (-27.1%)

- Adjusted net profit for the period: 79 million euro (+0.5%)

- Investments: 129 million euro (-8.6%)

- Adjusted net financial position: 2,600 million euro (+0.4% compared to June 30th 2019)

Operating highlights

- Active concessions: 2,137

- Active redelivery points: 4,340,670 (+0,2% compared to June 30th 2019)

- Distributed (natural and LPG) gas in millions of m3: 3,276 (-9.7% vs. June 30th 2019)

- Km of pipelines operated: 66,259 (+0.6% compared to June 30th 2019)

In the first half of the current year, 2iRG reported 348 million euro of Revenues net of line items offset with costs and includes non-recurring items (equal to zero during the analyzed period). Adjusted revenues item is therefore 348 million euro vs. 359 million euro of June 2019. The decrease is mainly a consequence of lower revenues from gas distribution (-8 million euro) due to Resolution 570/2019/R/gas, relating to tariff regulation for the period 2020-2025, which provides for a reduction in recognized operating costs and the regulatory WACC for gas metering. There was also a slight reduction in other revenues following the blocking of some activities following the regulatory provisions relating to the lockdown period.

Adjusted operating costs in the first half of 2020 totaled 109 million euro, with a reduction of about 9 million euro compared to the previous period (-7.3%). There was a decrease in operating costs

mainly due to the efficiency of personnel costs, the reduction of service costs and the lower net costs for Energy Efficiency Certificates (“TEE”).

Adjusted EBITDA amounted to 239 million euro, 3 million euro lower than in June 2019.

Adjusted EBIT amounted to 139 million euro, 3 million euro lower than in June 2019.

The Adjusted net profit for the period is equal to 79 million euro, substantially in line with the first half of 2019 (+0.5%), thanks to the reduction in net financial charges of 4 million euro.

In the first half of 2019, 2iRG’s gross investments amounted to 129 million euro (vs. 141 million euro, as of June 2019). The reduction is due to the slowdown in activities, in particular the massive replacement of smart meters during the lockdown period.

Net fixed assets in June 2020, mainly represented by intangible assets related to gas distribution concessions, are equal to 3,565 million euro, 51 million euro higher compared to June 2019 (+1.5%). The increase is driven by the normal trend of investments.

The adjusted net financial position rose from 2,589 million euro in the first half of 2019 to 2,600 million euro as of 30 June 2020 (+11 million euro). The slight increase, despite the positive operating performance, is mainly due to the increase in net fixed assets.

The Consolidated Interim Financial Report as of June 30th 2020 will be published on the company’s website www.2iretegas.it.

The following table illustrates the main financial figures of the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from the construction of distribution infrastructure recognised in accordance with IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (121 and 132 million euro in the first half of 2020 and 2019, respectively), are accounted for as a deduction of the relevant costs. (**) Excluding the adjustment to the payables for transaction costs associated with loans (11 and 13 million euro in the first half of 2020 and 2019, respectively) pursuant to IAS 39 and to the IFRS16 debt (equal to 27 and 27 million euro in the first half of 2020 and 2019, respectively)