Net Income for the period of € 182 million and Investments of € 372 million

Milan, 22 March 2024 – The Board of Directors of 2i Rete Gas S.p.A. approved today the consolidated results at 31 December 2023.

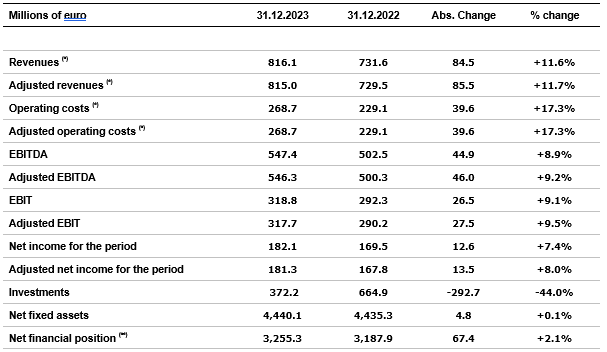

Financial highlights

- Adjusted Revenues: 815.0 million euro (+11.7%)

- Adjusted EBITDA: 546.3 million euro (+9.2%)

- Adjusted EBIT: 317.7 million euro (+9.5%)

- Adjusted net income: 181.3 million euro (+8.0%)

- Investments: 372.2 million euro (-44.0%)

- Net fixed assets: 4,440.1 million euro (+0.1%)

- Net financial position: 3,255.3 million euro (+2.1%)

Operational highlights

- Served municipalities: 2,226

- Active redelivery points: 4,863,979 (+0.1%)

- Distributed Gas (Natural gas and LPG) in millions of m3: 5,313 (-5.1%)

- Managed networks in Km: 71,939 (+0.3%)

In 2023 the Adjusted Revenues, net of line items offset with costs, amounted to 815.0 million euro (729.5 million euros in 2022). The increase (+85.5 million euro) was essentially attributable to the positive effects of the full management of the plants of the tender ATEM Napoli 1 won and recognition of a remuneration linked to the residual value of smart meters whose replacement occurred before the end of their useful life. The Revenues achieved by 2i Rete Gas in 2023 amounted to 816.1 million euro, including 1.1 million euro in non-recurring items related to the revenues for capital gains from disposals of concession Mortegliano in Udine 2 ATEM.

In 2023, Adjusted operating costs amounted to 268.7 million euro (229.1 million euro in 2022), without non-recurring expenses in the period. The increase (+17.3%) is mainly due to the increase in the scope of consolidation after the acquisition of ATEM Napoli 1 and to the impact of inflation on raw materials and services.

The Adjusted EBITDA amounted to 546.3 million euro, 46.0 million euro (+9.2%) higher compared to the previous period.

The Adjusted EBIT totalled 317.7 million euro, 27.5 million euro higher than 2022 (+9.5%).

The Adjusted net income is equal to 181.3 million euro, 13.5 million euro higher than 2022 (+8.0%). The increase is mainly due to the higher net financial charges (+8.4 million euro) consequence of increase in interest rates which affect the floating-rate loans and higher debt. The Net income, which includes extraordinary items, is equal to 182.1 million euro.

During 2023, 2i Rete Gas put in place gross investments of 372.2 million euro (664.9 million euro in 2022), decrease mainly due to the acquisition of ATEM Napoli 1. Excluding that acquisition, there is an increase in operating investments of around 17 million euro attributable to a great number of electronic meters installed and to higher investments for compliance with regulations and technical improvement of distribution network.

Net fixed assets in 2023 totalled 4,440.1 million euro, 4.8 million euro higher compared to 31 December 2022 (+0.1%). The increase was driven by the normal trend of investments despite the write off of the fair value of the hedging derivatives (103.7 million euro at the end of 2022) as a consequence of unwinding of Forward Starting Swap in place following the issuance, in June, of the new Debenture Loan they were intended to hedge.

The Net financial position, including financial liabilities from IFRS16 principles application (equal to 23.7 million euro), rose from 3,187.9 million euro in 2022 to 3,255.3 in 2023 (+2.1%). The increase of 67.4 million euro is the outcome of the growth in operative investments and net working capital (mainly consequence of receivables from CSEA) and positively influenced by the unwinding of the hedging derivatives.

Sustainability

During the year, 2i Rete Gas completed the connection with its distribution network of another biomethane production plant that is added to three connected during 2022. The four production plants connected to the 2i Rete Gas network allow the injection of a volume of biomethane equal to the annual needs of more than 13 thousand families in the provinces of Lodi, Asti, Lecce and Brescia. The use of biomethane, a renewable energy source obtained from the anaerobic digestion of agricultural and agro-industrial by-products as well as organic waste, makes it possible to meet the European decarbonisation objectives, to promote the increase in national gas production and to develop a concrete model of circular economy through the integration of the agri-food sector and that of environmental services with the energy supply chain.

During 2023 2i Rete Gas also recorded a further improvement in the ESG rating issued by Sustainalytics, with a “risk rating” which, while it was equal to 33.4 points in 2021 and 25.2 points in 2022, reached 22.6 points in 2023, confirming the positive trend of recognition of the efforts made in this field. 2i Rete Gas is therefore in the ranking of companies in the “Gas utilities” cluster in fifteenth position out of 96 companies, a sign of the commitment made during the year.

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (336.6 and 320.5 million euro in 2023 and 2022, respectively), are accounted for as a deduction of the relevant costs.

(**) Including the debt registered following the application of the IFRS16 principles (equal to 23.7 and 25.5 million euro in 2023 and 2022, respectively).