Today, the Board of Directors of 2i Rete Gas S.p.A., at the meeting chaired by Ms Paola Muratorio, approved the Consolidated Interim Financial Report at 30 June 2016.

Financial Highlights

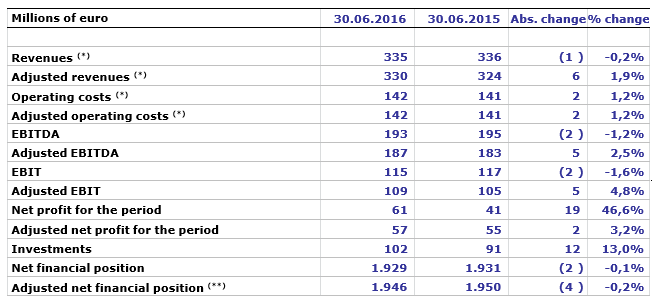

- Revenues: 335 million euro (-0.2%)

- Adjusted EBITDA: 187 million euro (+2.5 %)

- Adjusted EBIT: 109 million euro (+4.8%)

- Net profit for the period: 61 million euro (+46.6%)

- Adjusted net profit for the period: 57 million euro (+3.2%)

- Investments: 102 million euro (+13%)

- Adjusted net financial position: 1,946 million euro (-0.2% compared to 30 June 2015)

Operating Highlights

- Active concessions: 1,942

- Active redelivery points: 3,869,356 (+1.5% compared to 30 June 2015)

- Distributed (natural and LPG) gas in millions of m3: 3,040 (-4.5%)

- Km of pipelines operated: 58,068 (+1.0% compared to 30 June 2015)

The comment of Michele De Censi, 2i Rete Gas Chief Executive Officer and General Manager:

“The results for the first half of 2016 confirm the positive trend registered in 2015. Although regulatory WACC fell to 6.1% for distribution operations and 6.6% for metering operations, compared to 6.9% and 7.2%, respectively, in 2015, the company increased its EBITDA through further cost cutting.

The large-scale roll out of mass market meters, which involves over 500 Municipalities in Italy, is proceeding as planned. In the first half of 2016, we installed more than 350,000 meters.

The net cash flows from operating activities allowed us to finance the investments made in the period without affecting the net financial position.

The company has continued analysing and studying territorial tenders in order to be ready for the eagerly anticipated and inevitable resuming of the awarding process, and thus be able to seize market opportunities.”

In the first half of the current year, 2i Rete Gas S.p.A. reported 335 million euro in Revenues net of line items offset with costs. This amount included 5 million euro in non-recurring items. Adjusted revenues therefore totalled 330 million euro (324 million euro in 2015). The increase was largely attributable to the 10 million euro rise in revenue from energy efficiency certificates (as a result of the higher purchase volumes compared to the prior-year period) in spite of the revision of the regulatory WACC.

Adjusted operating costs for the first half of 2016 totalled 142 million euro (141 million euro in the prior-year period) and did not include any non-recurring items. Excluding the 9 million euro rise in the costs for energy efficiency certificates, operating costs were down 5.8%.

Adjusted EBITDA amounted to 187 million euro, up 5 million euro (+2.5%) from 30 June 2015.

Adjusted EBIT amounted to 109.5 million euro, up 5 million euro (+4.8%) from 30 June 2015.

The Adjusted net profit for the period amounted to 57 million euro, up 2 million euro (+3.2%) compared to the first half of 2015. The increase was due to the improved EBIT as well as the reduction in financial expenses compared to the first half of 2015 (-1 million euro), even though income tax expense for the period rose year-on-year.

In the first half of 2016, 2i Rete Gas S.p.A.’s gross investments totalled 102 million euro (91 million euro at 30 June 2015). The increase was largely attributable to the higher investments in electronic meters subsidised by the European Investment Bank.

At 30 June 2016, the adjusted net financial position amounted to 1,946 million euro, down from 30 June 2015 (-4 million euro). This was in spite of the 85 million euro rise in investments and dividends paid, as 2i Rete Gas S.p.A. achieved significant efficient gains.

The Consolidated Interim Financial Report at 30 June 2016 will be published on the company’s website www.2iretegas.it.

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from the construction of distribution infrastructure recognised in accordance with IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (95 and 71 million euro in the first half of 2016 and 2015, respectively), are accounted for as a deduction of the relevant costs. (**) Excluding the adjustment to the payables for transaction costs associated with loans (17 and 19 million euro in the first half of 2016 and 2015, respectively) pursuant to IAS 39