Today, the Board of Directors of 2i Rete Gas S.p.A., during the meeting chaired by Ms Paola Muratorio, approved the Consolidated Interim Financial Report at June 30th 2018.

Financial highlights

- Revenues: 430 million euro (+9%)

- Adjusted EBITDA: 227 million euro (+17%)

- Adjusted EBIT: 135 million euro (+15%)

- Net profit for the period: 76 million euro (+58%)

- Adjusted net profit for the period: 76 million euro (+11%)

- Investments: 132 million euro (+26%)

- Adjusted net financial position: 2,724 million euro (+32% compared to June 30th 2017)

Operating highlights

- Active concessions: 2,150

- Active redelivery points: 4,383,451 (+12% compared to June 30th 2017)

- Distributed (natural and LPG) gas in millions of m3: 3,605 (+11% vs. June 30th 2017)

- Km of pipelines operated: 66,064 (+13% compared to June 30th 2017)

Michele De Censi, 2i Rete Gas Chief Executive Officer and General Manager, has commented as follows:

“The results of the first half of 2018 underline the positive organic and inorganic growth trend of 2i Rete Gas. The Company achieved satisfactory results, well above the expectations.

On February 1st 2018, 2i Rete Gas completed the acquisition of the companies of Gas Natural Fenosa Group and in only 5 months the whole integration procedure has been finalized.

In the second half of the year, the Company will focus on new investments for technical implementations and on new activities aimed at improving the operational efficiency.”

In the first half of the current year, 2i Rete Gas S.p.A. reported 430 million euro in Revenues. The figure is offset with costs and includes non-recurring items (equal to zero during the analyzed period). Adjusted revenues therefore totalled 430 million euro vs. 395 million euro in 2017. The increase is largely attributable to higher distribution revenues, due to the variation of the scope of consolidation.

Adjusted operating costs in the first half of 2018 totalled 203 million euro (vs. 201 million euro reached in the previous period). The figure does not take into account non-recurring items – equal to 1 million euro during the period. The increase of 2 million euro is mainly related to higher personnel costs and service costs (both consequence of the widening of the scope of consolidation), positively counterbalanced by lower raw materials and energy efficiency certificates costs (in the first half of 2018 the company purchased less certificates than in the same period of the previous year ).

Adjusted EBITDA amounted to 227 million euro, 33 million euro higher (+17%) than in June 2017.

Adjusted EBIT amounted to 135 million euro, up 18 million euro (+15%) than in the first half of 2017.

The Adjusted net profit for the period is equal to 76 million euro, exceeding by 7 million euro (+11%) the result of the 30 June 2017. The improvement of EBIT (+15%), driven by higher revenues, has led to such growth, notwithstanding increased adjusted financial expenses (+ 5 million euro) due to the bonds issued for the new acquisitions.

In the first half of 2018, 2i Rete Gas S.p.A.’s gross investments amounted to 132 million euro (vs.

105 million euro, as of June 30th 2017). The increase was largely attributable to the higher investments for technical improvement of the distribution network.

The adjusted net financial position increased from 2,059 million euro in the first half of 2017 to 2,724 million euro as of 30 June 2018 (+664 million euro), mainly due to the acquisition of companies from Gas Natural Fenosa Group and C.G.M. S.r.l., to the dividends payment and thanks to the positive performance.

The Consolidated Interim Financial Report as of June 30th 2018 will be published on the company’s website www.2iretegas.it.

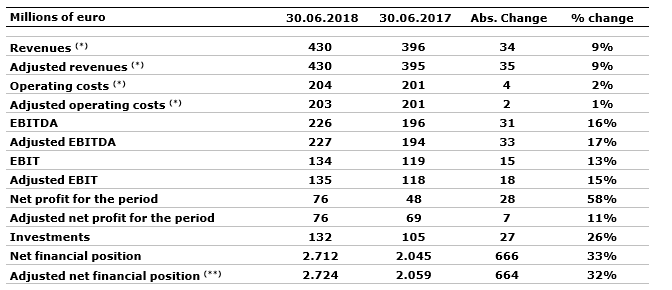

The following table illustrates the main financial figures of the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from the construction of distribution infrastructure recognised in accordance with IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (122 and 98 million euro in the first half of 2018 and 2017, respectively), are accounted for as a deduction of the relevant costs. (**) Excluding the adjustment to the payables for transaction costs associated with loans (12 and 14 million euro in the first half of 2018 and 2017, respectively) pursuant to IAS 39