NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES OR THE DISTRICT OF COLUMBIA (INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS) OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT)) (EACH, A U.S. PERSON) OR IN OR INTO OR TO ANY PERSON LOCATED OR RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

Milan, 7 June 2023. 2i Rete Gas S.p.A. (the Offeror) hereby announces, on a non-binding basis, the indicative results of its invitation to all holders (the Noteholders) of its €600,000,000 3.00 per cent. Notes due 16 July 2024 (ISIN: XS1088274672) (the Notes), out of which €577,393,000 is currently outstanding, to tender the Notes for purchase by the Offeror for cash up to an aggregate maximum acceptance amount of €300,000,000 in aggregate nominal amount, subject to the Offeror’s right in its sole and absolute discretion to increase or decrease such amount (the Maximum Acceptance Amount) subject to the satisfaction of the New Issue Condition and the other conditions described in the tender offer memorandum dated 30 May 2023 (the Tender Offer Memorandum) (the Offer).

The Offer was announced on 30 May 2023 and was made subject to the offer and distribution restrictions set out in the Tender Offer Memorandum. Capitalised terms used in this announcement and not otherwise defined have the meanings ascribed to them in the Tender Offer Memorandum.

The Offeror hereby announces that the New Issue Condition has been satisfied on 6 June 2023. The Expiration Deadline for the Offer was 5.00 pm (CEST) on 6 June 2023.

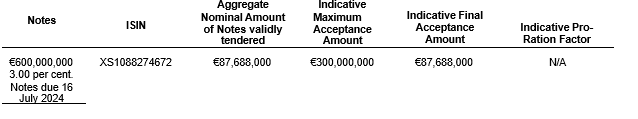

As at the Expiration Deadline, €87,688,000 in aggregate principal amount of the Notes had been validly tendered pursuant to the Offer. Following the Expiration Deadline, the Offeror hereby announces its non- binding intention to accept for purchase Notes validly tendered pursuant to the Offer as set out below.

The following table sets out the aggregate nominal amount of Notes validly tendered pursuant to the Offer, the indicative Maximum Acceptance Amount, the indicative Final Acceptance Amount and the indicative Pro-Ration Factor in relation to the Notes.

As soon as reasonably practicable today following the Pricing Time, the Offeror shall make a further announcement of whether it will accept and purchase validly tendered Notes pursuant to the Offer and, if so, (i) the final Maximum Acceptance Amount, (ii) the Final Acceptance Amount, (iii) the aggregate nominal amount of Notes validly tendered, (iv) any Pro-Ration Factor, (v) the principal amount of Notes that will remain outstanding after the Tender Offer Settlement Date and (vi) the July 2024 Interpolated Mid-Swap Rate, the Purchase Yield and the Purchase Price.

The settlement of the Offer is expected to occur on 9 June 2023.

Questions and requests for assistance in connection with the Offer may be directed to:

OFFEROR 2i Rete Gas S.p.A.

Via Alberico Albricci, 10 20122 Milan Italy

DEALER MANAGERS

BNP Paribas

16, boulevard des Italiens 75009 Paris France

Tel: +33 1 55 77 78 94

Attenzione: Liability Management Group

Email: liability.management@bnpparibas.com

BofA Securities Europe SA

51, rue La Boétie 75008 Paris France

Attenzione: Liability Management Group

Tel: +33 1 877 01057

Email: DG.LM-EMEA@bofa.com

Goldman Sachs International

Shoe Lane, 25 EC4A 4AU London United Kingdom

Tel: +44 20 7774 4836

Email: liabilitymanagement.eu@gs.com

Attenzione: Liability Management

UniCredit Bank AG

Arabellastrasse 12 81925 Munich Germany

Attenzione: Liability Management

Tel: +49 89 3781 3722

Email: corporate.lm@unicredit.de

TENDER AGENT

Kroll Issuer Services Limited

The Shard 32 London Bridge Street London SE1 9SG United Kingdom

Attenzione: Jacek Kusion

Tel: +44 (0)20 7704 0880

Email: 2iretegas@is.kroll.com

Sito web: https://deals.is.kroll.com/2iretegas

None of the Dealer Managers, the Tender Agent or any of their respective directors, officers, employees,

agents, advisors or affiliates assumes any responsibility for the accuracy or completeness of the

information concerning the Offeror, the Notes or the Offer contained in this announcement or in the

Tender Offer Memorandum.