High growth of adjusted EBITDA equal to € 627 million, adjusted Net Income +26.3% and Investments of € 368 million

Milan, 12 February 2025 – The Board of Directors of 2i Rete Gas S.p.A. approved today the consolidated results at 31 December 2024.

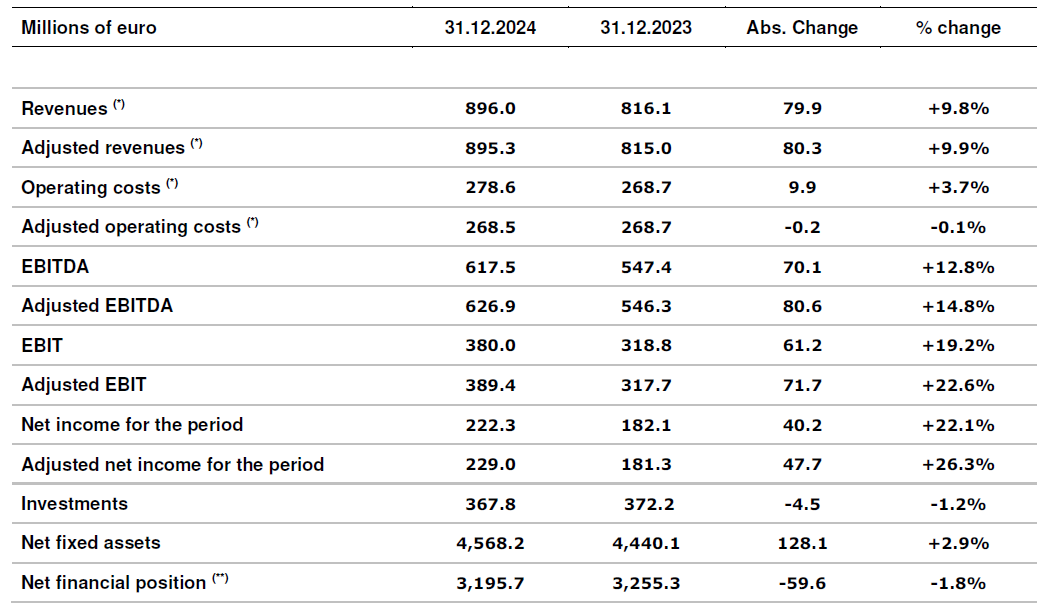

Financial highlights

- Adjusted Revenues: 895.3 million euro (+9.9%)

- Adjusted EBITDA: 626.9 million euro (+14.8%)

- Adjusted EBIT: 389.4 million euro (+22.6%)

- Adjusted net income: 229.0 million euro (+26.3%)

- Investments: 367.8 million euro (-1.2%)

- Net fixed assets: 4,568.2 million euro (+2.9%)

- Net financial position: 3,195.7 million euro (-1.8%)

Operational highlights

- Served municipalities: 2,226

- Active redelivery points: 4,858,340 (-0.1%)

- Distributed Gas (Natural gas and LPG) in millions of m3: 5,352 (+0.7%)

- Managed networks in Km: 72,146 (+0.3%)

In 2024 the Adjusted Revenues, net of line items offset by costs, amounted to 895.3 million euro (815.0 million euro in 2023). The significant increase (+80.3 million euro) was essentially attributable to the update of regulatory remuneration rate (increased to 6.5% in 2024), the increase of RAB due to higher investments and recognition of a remuneration linked to the residual value of smart meters whose replacements occurred before the end of their useful life. The Revenues of 2i Rete Gas in 2024 amounted to 896.0 million euro, including 0.7 million euro in non-recurring items related to capital gains from the disposal of the Locate Triulzi concession.

In 2024, Adjusted operating costs amounted to 268.5 million euro, excluding non-recurring expenses of 10.1 million euro related to the stock exchange listing process started and stopped during the year and for the commitments deriving from the signing of the agreement for the sale of shares from the shareholders F2i SGR and Finavias to Italgas S.p.A.. The adjusted operating costs are in line with the previous year (268.7 million euro in 2023).

Adjusted EBITDA amounted to 626.9 million euro, an increase of 80.6 million euros (+14.8%) compared to the previous period.

Adjusted EBIT totalled 389.4 million euro, 71.7 million euro higher than 2023 (+22.6%).

Adjusted net income is equal to 229.0 million euro, 47.7 million euro higher than 2023 (+26.3%). The increase is mainly due to the higher Adjusted EBITDA, the decrease in finance charges despite higher current taxes. Net income, which includes extraordinary items, amounted to 222.3 million euro.

During 2024, 2i Rete Gas made gross investments of 367.8 million euro (372.2 million euro in 2023), decrease mainly due to the price adjustment paid in 2023 for the acquisition of ATEM Napoli 1 occurred in 2022. Excluding that price adjustment, there was an increase of approximately 6 million euro in operating investments attributable to the large number of electronic meters installed, higher investments in regulatory compliance, and upgrades and technical development of the distribution network during 2024.

Net fixed assets, equal to 4,568.2 million euros, increased by 128.1 million euros compared to 31 December 2023 (+2.9%), mainly due to the investments made during the year.

The Net financial position, including financial liabilities from IFRS16 principles application (equal to 22.9 million euro), rose from 3,255.3 million euro in 2023 to 3,195.7 in 2024 (-1.8%). The decrease of 59.6 million euro was the result of the positive cash flow evolution, primarily due to a reduction in net working capital, stabilized by government action on pass-through items in 2022 and 2023.

Sustainability

During the year, 2i Rete Gas completed the connection with its distribution network of two other biomethane production plants which were added to four connected during 2022 and 2023. The six production plants connected to the 2i Rete Gas network enable the injection of a volume of biomethane equal to the annual needs of more than 23 thousand families in the provinces of Novara, Lodi, Asti, Lecce and Brescia. The use of biomethane, a renewable energy source obtained from the anaerobic digestion of agricultural and agro-industrial by-products as well as organic waste, makes it possible to meet the European decarbonisation objectives, to promote the increase in national gas production and to develop a concrete model of circular economy.

The Company continued its commitment to reducing climate-altering emissions, achieving a 10.5% reduction compared to 2023 on CO2eq Scope 1 and 2 emissions and, in light of this commitment, it saw the assignment of the Gold Standard confirmed, the highest recognition provided by the OGMP 2.0 Framework of the Oil & Gas Methane Partnership, which the Company has voluntarily joined since 2022.

During 2024, 2i Rete Gas received the Provisional Rating from MSCI, which assigned the company a AAA rating. In terms of Benchmarking, the company is in the highest quartile on health and safety issues and in the second quartile on carbon emissions issues.

Furthermore, in terms of valorising people and promoting an inclusive culture, during the financial year the certification on gender equality was obtained in accordance with the UNI PdR 125:2022 practice.

The table below shows the highlights from the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (349.1 and 336.6 million euro in 2024 and 2023, respectively), are accounted for as a deduction of the relevant costs.

(**) Including the debt registered following the application of the IFRS16 principles (equal to 22.9 and 23.7 million euro in 2024 and 2023, respectively).