Milan, 20 September 2017 – Today, the Board of Directors of 2i Rete Gas S.p.A., at the meeting chaired by Ms Paola Muratorio, approved the Consolidated Interim Financial Report at 30 June 2017.

Financial highlights

- Revenues: 396 million euro (+18.1%)

- Adjusted EBITDA: 194 million euro (+3.7%)

- Adjusted EBIT: 118 million euro (+7.7%)

- Net profit for the period: 48 million euro (-21.1%)

- Adjusted net profit for the period: 69 million euro (+20.7%)

- Investments: 105 million euro (+13%)

- Adjusted net financial position: 2,059 million euro (+5.8% compared to 30 June 2016)

Operating highlights

- Active concessions: 1,943

- Active redelivery points: 3,904,154 (+0.9% compared to 30 June 2016)

- Distributed (natural and LPG) gas in millions of m3: 3,242 (+6.6%)

- Km of pipelines operated: 58,356 (+0.5% compared to 30 June 2016)

The comment of Michele De Censi, 2i Rete Gas Chief Executive Officer and General Manager:

“The results for the first half of 2017 confirm the positive trend of 2i Rete Gas registered in 2016, with particularly satisfactory performance.

In the first part of the semester, the company played a leading role in a complex liability management exercise that led to the redefinition of the maturities of a part of the funding sources, obtaining, thanks to favorable market acceptance, financial conditions suitable to support the path of growth expected of the Group in the coming years.

In the first half of 2017, with the submission of the offer, the work for the participation in the tender for the distribution service in ATEM Milan 1 was completed.

During the year, the actions to improve operational efficiency and costs reduction will continue.”

In the first half of the current year, 2i Rete Gas S.p.A. reported 396 million euro in Revenues net of line items offset with costs. This amount included 1 million euro in non-recurring items. Adjusted revenues therefore totalled 395 million euro (330 million euro in 2016). The increase is largely attributable to the 57 million rise in revenue from white certificates (due to the higher purchase volumes and higher market prices of energy efficiency certificates in the first half of 2017 compared to the same period of the previous year).

Adjusted operating costs for the first half of 2017 totalled 200 million euro (142 million euro in the prior-year period) and did not include any non-recurring items. Excluding the 58 million euro rise in the costs for energy efficiency certificates, operating costs were down 0.3%.

Adjusted EBITDA amounted to 194 million euro, up 7 million euro (+3.7%) from 30 June 2016.

Adjusted EBIT amounted to 118 million euro, up 8 million euro (+7.7%) from 30 June 2016.

The Adjusted net profit for the period amounted to 69 million euro, up 12 million euro (+20.7%) compared to the first half of 2016. The increase was due to the improved EBIT as well as the reduction in adjusted financial expenses (-2 million euro) and lower taxes (-2 million euro) compared to the first half of 2016.

In the first half of 2016, 2i Rete Gas S.p.A.’s gross investments totalled 105 million euro (102 million euro at 30 June 2016). The increase was largely attributable to the higher investments for technical improvement of the distribution network.

The adjusted net financial position increased from 1,946 million euro in the first half of 2016 to 2,059 million euro on 30 June 2017 (+113 million euro), mainly due to the payment of financial charges for the liability management exercise (29 million euro) and the paid dividends of 85 million euro.

The Consolidated Interim Financial Report at 30 June 2017 will be published on the company’s website www.2iretegas.it.

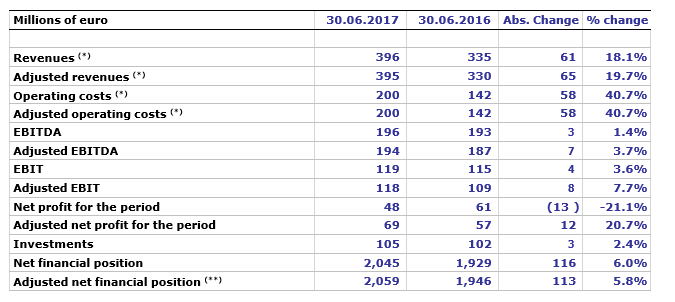

The following table illustrates the main financial figures of the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from the construction of distribution infrastructure recognised in accordance with IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (99 and 95 million euro in the first half of 2017 and 2016, respectively), are accounted for as a deduction of the relevant costs. (**) Excluding the adjustment to the payables for transaction costs associated with loans (14 and 17 million euro in the first half of 2017 and 2016, respectively) pursuant to IAS 39