Net Income of € 113 million and investments of € 178 million

The Board of Directors of 2i Rete Gas S.p.A. approved today the Consolidated Interim Financial Report at June 30th 2024.

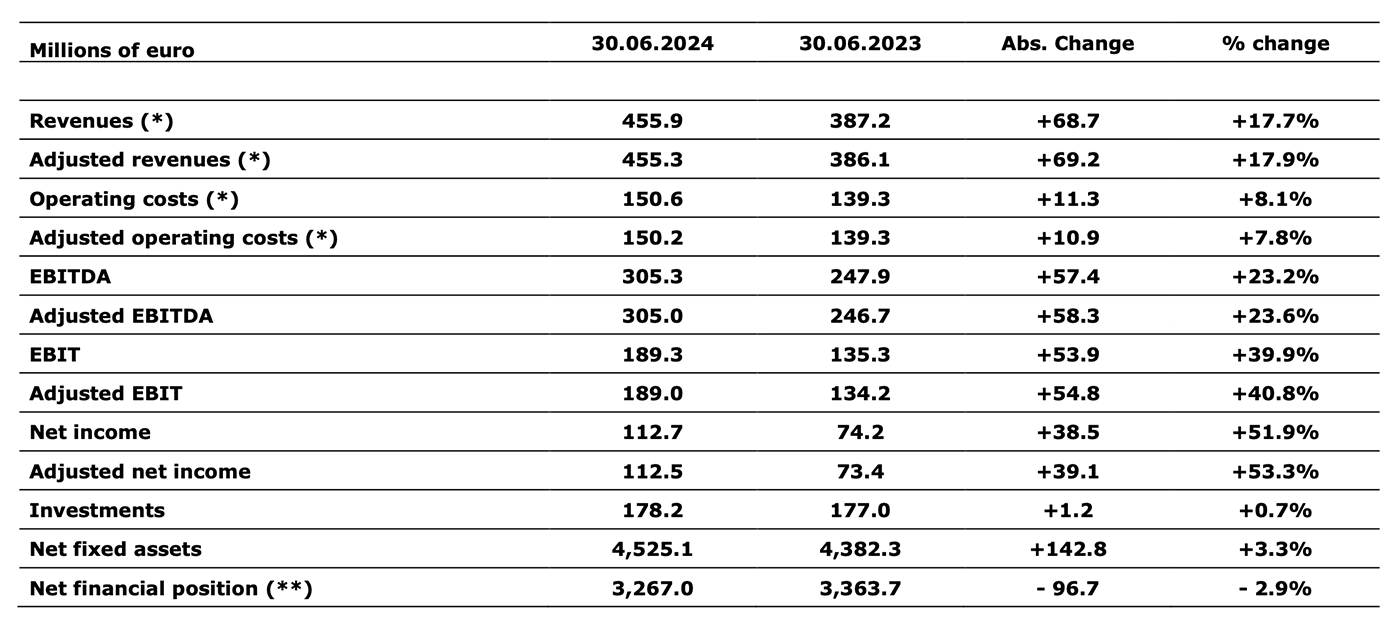

Financial highlights

- Revenues: 455.9 million euro (+17.7%)

- Adjusted EBITDA: 305.0 million euro (+23.6%)

- Adjusted EBIT: 189.0 million euro (+40.8%)

- Adjusted Net profit: 112.5 million euro (+53.3%)

- Investments: 178.2 million euro (+0.7%)

- Net fixed assets: 4,525.5 million euro (+3.3% compared to June 30th 2023)

- Net financial position: 3,267.0 million euro (-2.9% compared to June 30th 2023)

Operational highlights

- Served municipalities: 2,225

- Active redelivery points: 4,859,130 (-0.02% compared to June 30th 2023)

- Distributed Gas in millions of m3: 3,023 (-3.5%)

- Managed networks in Km: 71,992 (+0.3% compared to June 30th 2023)

In the first half of the current year, 2i Rete Gas reported 455.9 million euro of Revenues, net of line items offset with costs. This amount included 0.6 million euro in non-recurring items, related to the capital gain for the definition of the amounts of the assets sold. Adjusted revenues item is therefore 455.3 million euro (386.1 million euro as of June 2023). The increase (+17.9%) is mainly due to the update of regulatory remuneration rate (increased to 6.5% in 2024) and revenues tied to the residual value of smart meters replaced before the end of their useful life thanks to Determination 1/2023.

Adjusted operating costs in the first half of 2024 totalled 150.2 million euro and did not include special items of 0.4 million euro. The increase registered (+8.0%) is mainly due to charges for compensation and penalties on metering and provisions for risks and charges that may arise from the replacement of meters.

Adjusted EBITDA amounted to 305.0 million euro, 58.3 million euro (+23.6%) higher compared to the previous period.

Adjusted EBIT amounted to 189.0 million euro, 54.8 million euro higher than in June 2023 (+40.8%).

The Adjusted net income is equal to 112.5 million euro, 39.1 million euro higher (+53.3%) than in June 2023 mainly due to the increase of Adjusted EBITDA and current taxes.

The Net income, which includes extraordinary items, is equal to 112.7 million euro.

In the first half of 2023 the company put in place gross investments of 178.2 million euro (177.0 million euro as of June 2023).

Net fixed assets in June 2024, mainly represented by intangible assets related to gas distribution concessions, are equal to 4,525.1 million euro, 142.8 million euro higher compared to June 2023 (+3.3%). The increase was driven by the normal trend of investments and receivable from CSEA following Determination 1/2023.

The Net financial position dropped from 3,363.7 million euro in the first half of 2023 to 3,267.0 million euro as of 30 June 2024 (-2.9%). The decrease is mainly due to reduction of Net working capital (mainly deriving from VAT credits from the tax authorities).

The following table illustrates the main financial figures of the consolidated financial statements.

(*) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (170.7 and 167.1 million euro in the first half of 2024 and 2023, respectively), are accounted for as a deduction of the relevant costs.

(**) Including the debt registered following the application of the IFRS16 principles (equal to 22.0 and 23.1 million euro in the first half of 2023 and 2023, respectively).