Net Income for the period of € 170 million and Investments of € 665 million for the acquisition of ATEM Napoli 1

The Board of Directors of 2i Rete Gas S.p.A. approved today the consolidated results at 31 December 2022 and resolved to propose to the Shareholders’ Meeting, called for 27 April 2023, the distribution of a dividend of 111 million euro (corresponding to a payout ratio equal to 66% of the Adjusted net profit).

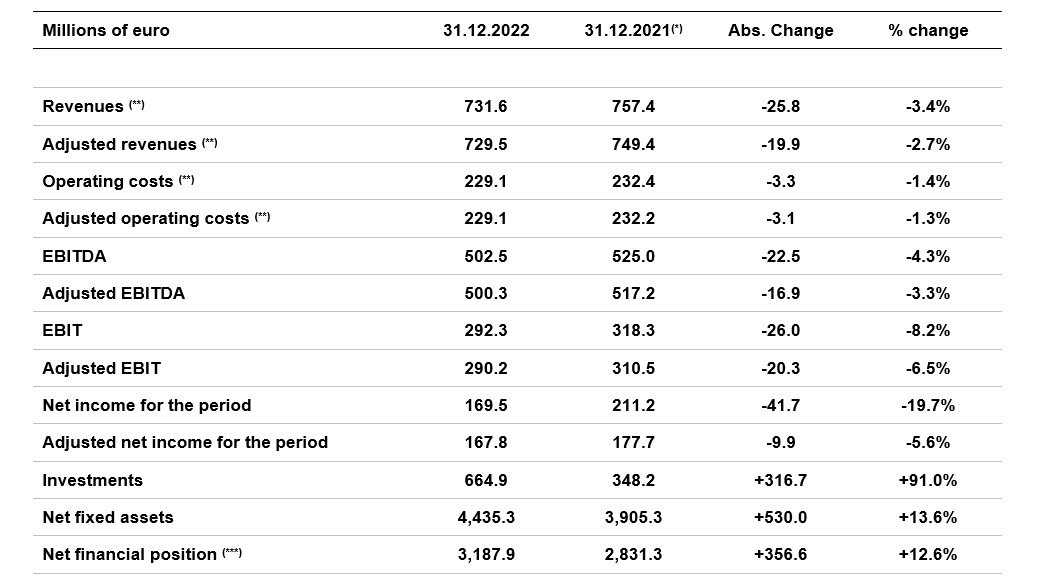

Financial highlights

- Adjusted Revenues: 729.5 million euro (-2.7%)

- Adjusted EBITDA: 500.3 million euro (-3.3%)

- Adjusted EBIT: 290.2 million euro (-6.5%)

- Adjusted net income: 167.8 million euro (-5.6%)

- Investments: 664.9 million euro (+91.0%)

- Net fixed assets: 4,435.3 million euro (+13.6%)

- Net financial position: 3,187.9 million euro (+12.6%)

Operational highlights

- Served municipalities: 2,226

- Active redelivery points: 4,861,083 (+7.5%)

- Distributed Gas (Natural gas and LPG) in millions of m3: 5,599 (-12.4%)

- Managed networks in Km: 71,755 (+2.7%)

In 2022 the Adjusted Revenues, net of line items offset with costs, amounted to 729.5 million euro (749.4 million euros in 2021). The decrease (-19.9 million euro) was essentially attributable to lower revenues from gas distribution due to lower net rate of return on invested capital (WACC) envisaged in Resolution no. 614/2021/R/com and lower operating costs recognized pursuant to Resolution 570/2019/R/gas (approximately -31 million euro overall), partly offset by the increase in the RAB for higher investments, from the full contribution of the incorporated company Infrastrutture Distribuzione Gas and finally from the first positive effects of the management of the plants of the tender ATEM Napoli 1 won (consolidated for one month starting from 1 December 2022). The Revenues achieved by 2i Rete Gas in 2022 amounted to 731.6 million euro, including 2.1 million euro in non-recurring items related to the revenues for capital gains from disposals of concessions (in particular Cinisello Balsamo).

In 2022, Adjusted operating costs amounted to 229.1 million euro (232.2 million euro in 2021), without non-recurring expenses in the period. Despite a high inflation environment, the increase in

labour cost due to the lower use of personnel for investment activities and the increase in the scope of consolidation after the acquisition of ATEM Napoli 1, there was a reduction in operating costs (- 1.3%) mainly due to operating efficiencies and lower losses from disposals of assets and provisions for risks.

The Adjusted EBITDA amounted to 500.3 million euro, 16.9 million euro lower than 2021 (-3.3%). The Adjusted EBIT totalled 290.2 million euro, 20.3 million euro lower than 2021 (-6.5%).

The Adjusted net income was equal to 167.8 million euro, 9.9 million euro lower than 2021 (-5.6%). The Net income, which includes extraordinary items, is equal to 169.5, while the total comprehensive income in the year, which also includes the change in the fair value of hedging derivatives, is equal to 257.6 million euro, 25.7 million euro higher compared to the previous year (+11.1%).

During 2022, 2i Rete Gas put in place gross investments of 665 million euro (348 million euro in 2021), mainly as a result of the acquisition of ATEM Napoli 1. Excluding that acquisition, there is a slight decrease in operating investments of around 4 million euro due to the imminent end of the replacement of traditional meters with electronic ones.

Net fixed assets in 2022 totalled 4,435.3 million euro, 530.0 million euro higher compared to 31 December 2021 (+13.6%). The increase was driven by the plants acquisition in the year and the normal trend of investments.

The Net financial position, including financial liabilities from IFRS16 principles application (equal to 25.5 million euro), rose from 2,831.3 million euro in 2021 to 3,187.9 in 2022 (+12.6%). The increase of 356.6 million euro is the outcome of the growth in net fixed asset amount financed by own means and positive operating results. The accounting net financial debt, which also includes the fair value of derivatives, amounted to 3,084.2, up by 242.7 million euro compared to 31 December 2021 (+8.5%).

Sustainability

During the year, 2i Rete Gas completed the connection with its distribution network of three biomethane production plants owned by third-party companies, with the simultaneous start of injection of the produced biomethane. The three production plants are connected to the 2i Rete Gas network through as many regulation, measurement and quality control cabins, which allow the injection of a volume of biomethane equal to the annual needs of around ten thousand families when fully operational. The use of biomethane, a renewable energy source obtained from the anaerobic digestion of agricultural and agro-industrial by-products as well as organic waste, makes it possible to meet the European decarbonisation objectives, to promote the increase in national gas production and to develop a concrete model of circular economy through the integration of the agri-food sector and that of environmental services with the energy supply chain.

During 2022, 2i Rete Gas also recorded a significant improvement in the unsolicited ESG ratings issued (i) by Sustainalytics, as the company went from 33.4 risk rating points to 25.2 points, with an improvement in particular in the Management parameter from 27.9 (average) to 50.8 (Strong) with the same risk exposure (47.9) and (ii) by Moody’s ESG Solutions, recording an increase of 11 points (from 34 in the 2020 score and 2021 to 45 points out of 100 for 2022), with an improvement in all metrics used by Moody’s ESG Solutions for appraisal, including the “Carbon Footprint” score which

improved from B (significant) to A (moderate). In particular, the Moody’s ESG Solutions materiality matrix explicitly highlighted further corporate strengths, in addition to the anti-corruption safeguards already appreciated in previous years’ reports, including the strategy for environmental impact mitigation, good corporate practices ESG and the quality of the relationship with customers and proximity to the Community.

The table below shows the highlights from the consolidated financial statements.

(*) Net fixed assets and net financial position re-formed compared to exposed data in 2021.

(**) Exclusively for the purposes of the reclassified income statement, revenues from construction of the network distribution ex IFRIC 12 “Service Concession Arrangement”, which are measured to the extent of the relevant costs incurred (320.5 and 319.4 million euro in 2022 and 2021, respectively), are accounted for as a deduction of the relevant costs.

(***) Including the debt registered following the application of the IFRS16 principles (equal to 25.5 and 25.6 million euro in 2022 and 2021, respectively).